General Questions (Basic Information) for Financial Aid

FAFSA Questions

The Free Application for Federal Student Aid (FAFSA®) form is an application for federal student aid. You need to complete the FAFSA form to apply for federal student aid such as federal grants, work-study funds, and loans. Completing and submitting the FAFSA form is free and easier than ever, and it gives you access to federal student aid—the largest source of aid— to help you pay for college or career/trade school.

In addition, many states and colleges use your FAFSA information to determine your eligibility for state and school aid. Some private aid providers may use your FAFSA information to determine whether you qualify for their aid.

To create a StudentAid.gov account username and password, follow these steps:

- Go to Create Account.

- Provide your name, date of birth, and Social Security number (SSN) if applicable.

- Enter a unique username.

- Enter your email address.

- Enter a strong password.

- Enter your mailing address.

- Enter your mobile phone number. Select the box to indicate if you would like to register your mobile phone to receive one-time secure codes if you forget your username or password. (You’ll be required to provide either your email address or your mobile phone number and to opt in to messaging before you can proceed.)

- Select your communication preferences.

- For security purposes, complete the challenge questions and answers.

- Confirm and verify your information.

- Agree to the terms and conditions.

- Enable two-step verification by verifying your email address and/or mobile phone. You can also use an authenticator app.

- Write down your back-up code.

If you don’t have a Social Security number, learn about creating an account without a Social Security number (SSN).

The FAFSA that launched on January 1 is the 2024–2025 FAFSA, which covers the period from July 1, 2024 through June 30, 2025. So if you’re going to be in school during that period, then yes, you do need to fill out a FAFSA again. You have to fill out a FAFSA each year while in school in order to apply for aid.To renew your FAFSA, go to studentaid.gov, select “Login” to log in, and you will be given the option to complete a FAFSA Renewal that has much of your application data from last year. Students who provided their email address on the FAFSA will receive email notification of the FAFSA Renewal online.

You will need your FSA ID Username and Password to access your 2023–2024 FAFSA. If you’ve not set up your FSA ID, you can create the FSA ID here.

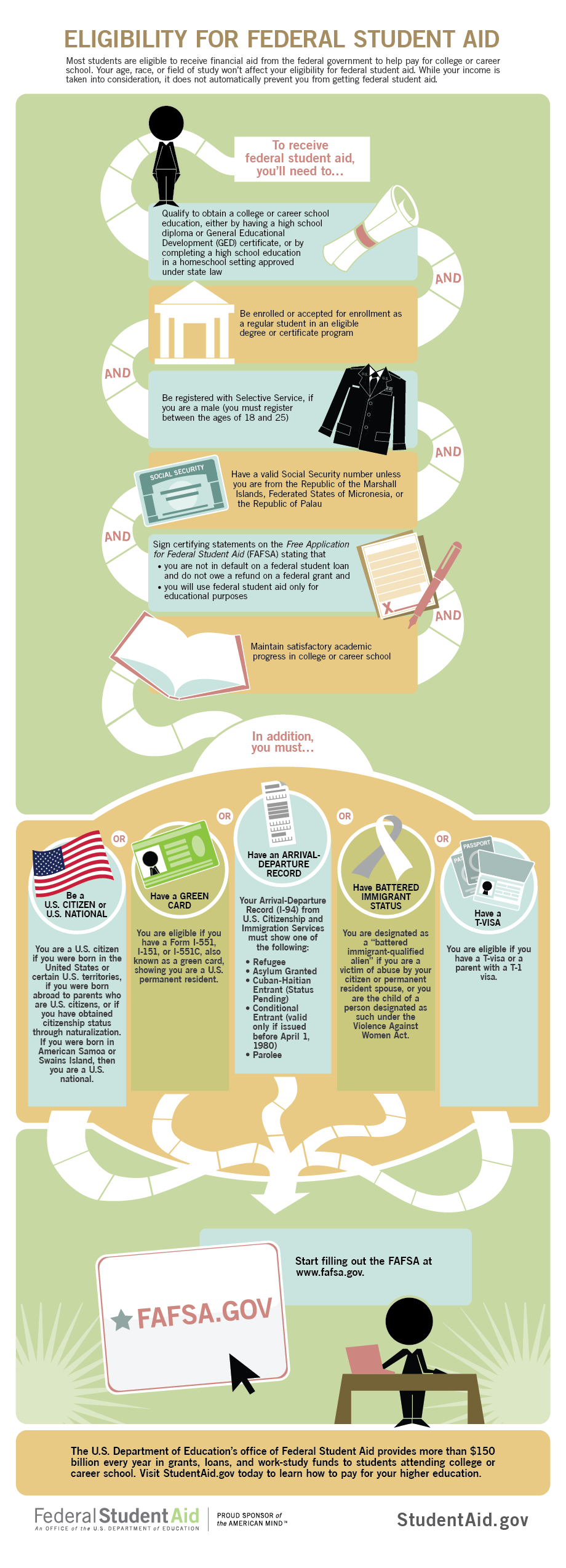

Nearly every student is eligible for some form of financial aid, regardless of income, provide that you:

- demonstrate financial need for need-based federal student aid programs;

- be a U.S. citizen or an eligible noncitizen;

- have a valid Social Security number (with the exception of students from the Republic of the Marshall Islands, Federated States of Micronesia, or the Republic of Palau);

- be enrolled or accepted for enrollment as a regular student in an eligible degree or certificate program;

- maintain satisfactory academic progress in college or career school;

- provide consent and approval to have your federal tax information transferred directly into your 2024–25 Free Application for Federal Student Aid (FAFSA®) form, if you’re applying for aid for July 1, 2024, to June 30, 2025;

- sign the certification statement on the FAFSA form stating that you’re not in default on a federal student loan, you do not owe money on a federal student grant, and you’ll only use federal student aid for educational purposes; and

- show you’re qualified to obtain a college or career school education.

- Go to www.fafsa.gov and click on “Start A New FAFSA.”

- Complete and electronically submit the free application, FAFSA.

- Federal School Code for Columbia College is 041273

You’ll need the following to complete a Free Application for Federal Student Aid (FAFSA®) form:

For those completing a 2024–25 FAFSA form, you need the following information:

- Your Social Security Number

- Your A-Number (if you’re not a U.S. citizen)

- Federal income tax returns, records of child support received; and your current balance of cash, savings, and checking accounts (Note: You must provide consent and approval to disclose your federal tax information to be eligible for federal student aid.)

- Bank statements and records of investments (if applicable), net worth of investments, businesses, and farms

- Records of untaxed income (if applicable)

- An FSA ID (account username and password) to log in to StudentAid.gov and start the FAFSA form electronically

For those completing a 2023–24 FAFSA form, you need your Social Security number, your Alien Registration number (if you’re not a U.S. citizen), your federal income tax returns, W-2s, and other records of money earned (Note: You may be able to transfer your federal tax return information into your FAFSA form using the IRS Data Retrieval Tool)

If you’re a dependent student, then you will also need most of the above information for your parent(s).

The SAR is a needs-analysis document generated by the Federal Processor based on the financial data you supplied. If corrections are necessary, the SAR will indicate as such and will direct you to make correction. If Financial Aid Office requires additional documentation, students should provide their school with necessary documents.

If you didn’t work for last year so you didn’t have income you can select “Not going to File” for your tax filing status.

Enter the amount of any cash support you received from a friend or relative (other than your parents, if you are a dependent student). Cash support includes payments made on your behalf. For instance, if your aunt pays your rent or utility bills, you must report those payments here.

If you meet the basic eligibility criteria for federal student aid, the financial aid office at your college or career school determines how much aid you are eligible to receive.

Your eligibility depends on your Student Aid Index (2024–25 FAFSA form) or Expected Family Contribution (2023–24 FAFSA form), your year in school, your enrollment status, and the cost of attendance at the school you will be attending.

This is how they do it:

- The financial aid staff starts by determining your cost of attendance (COA) at that school.

- They then consider your Student Aid Index (SAI) (2024-25 FAFSA form) or Expected Family Contribution (EFC) (2023–24 FAFSA form).

- They subtract your SAI/EFC from your COA to determine the amount of your financial need and therefore how much need-based aid you can get.

- To determine how much non-need-based aid you can get, the school takes your cost of attendance and subtracts any financial aid you’ve already been awarded.

Cost of Attendance (COA) – Student Aid Index (SAI) = Financial Need

For the 2024–2025 Award Year, a student is automatically determined to be independent for federal student aid purposes if he or she meets one or more of the following link: www.studentaid.gov/dependency

There are several options for checking your application status:

- Student Financial Aid Services, Inc. users can log in to their My FAFSA account on the secure website to check their application status online at any time.

- Call the Federal Student Aid Information Center at 1.800.433.3243 to learn the status of your FAFSA

- Check the status of your application online through the ED website at studentaid.gov

- Contact your school’s financial aid administrators for information

Once your financial aid file is completed, you will receive a financial aid award notice that specifies the amount you can receive.

There are three verification groups for the 2024-2025 award year. The Office of Financial Aid may request you to provide the following documents based on your group selected groups: Independent (or Dependent)

| V1-Standard |

|

| V4-Custom |

|

| V5-Aggregate |

|

- 2021 federal IRS tax return transcript (form 4506-T): available on the IRS website at www.irs.gov

- Columbia College Independent (dependent) Verification Worksheet

- Refer to Verification Process

How can I request my “Tax Return Transcript”?

IRS Tax Return Transcript Request Process (Not Tax Account Transcript)

Tax filers can request a transcript, free of charge, of their Federal Income Tax Return Transcript from the IRS in one of the following ways.

OPTION 1: Online Immediate Assess to Your Electronic Tax Transcript(Number)

- Go to www.irs.gov, click “Get Your Tax Record.”

- Click “Get Transcript Online.”

- Make sure to request the “Return Transcript” and NOT the “Account Transcript.” To use the Get Transcript Online tool, the user must have

- (1) access to a valid email address

- (2) a text-enabled mobile phone (pay-as-you-go plans cannot be used) in the user’s name, and

- (3) specific financial account numbers (such as a credit card number or an account number for a home mortgage or auto loan).

- The transcript displays online upon successful completion of the IRS’s two-step authentication.

OPTION 2: Online Request for Mailed Transcript

- Go to www.irs.gov, click “Get Your Tax Record.”

- Click “Get Transcript by Mail.” Make sure to request the “Return Transcript” and NOT the “Account Transcript.”

- The transcript is generally received within 10 business days from the IRS’s receipt of the online request.

OPTION 3: Telephone Request for Mailed Transcript

- Available on the IRS by calling 1-800-908-9946. Transcript is generally received within 10 business days from the IRS’s receipt of the telephone request.

If one of above three ways was unsuccessful, please do the following step.

OPTION 4: Paper Request for mailed Transcript –IRS Form 4506T-EZ or 4506-T(Number)

- IRS Form 4506T-EZ or IRS Form 4506-T. The transcript is generally received within 10 business days from the IRS’s receipt of the paper request form.

- IRS Form 4506T-EZ should be used. (Download 4506T-EZ)

- Mail or fax the completed IRS Form 4506T-EZ to the appropriate address (or FAX number) provided on page 2 of Form 4506T-EZ.

- Tax filers can expect to receive their transcript within 5 to 10 days from the time the IRS receives and processes their signed request.

- Processing form 4506T-EZ means verifying the information provided on the form. If any information does not match the IRS records, the IRS will notify the tax filer that it is not able to provide the transcript.

- If the IRS cannot provide tax transcript, submit the following four documents.

- Tax non-filers have to use IRS Form 4506-T (Download at 4506-T ) with check #7 Verification of Non-filing.

- If the IRS cannot provide the tax transcript, the following four documents must be submitted by the student.

Documents must be submitted to Columbia College

- A signed copy of tax refund of prior year

- The printed IRS Web pages with the message (1&2)

- The copy of the completed and signed Form 4506T-EZ

- The copy of the IRS response to Form 4506T-EZ with signature and date by student

- Make corrections directly online at https://studentaid.gov/apply-for-aid/fafsa/review-and-correct/correct by clicking “Make a correction.” An updated SAR will be e-mailed to you—typically within 3 days.

- To add a college to your FAFSA application or to update a mailing address, you may call the Federal Student Aid Information Center at 1.800.433.3243.