POLICIES, RULES & REGULATIONS

Awarding of Federal (Title IV) Funds

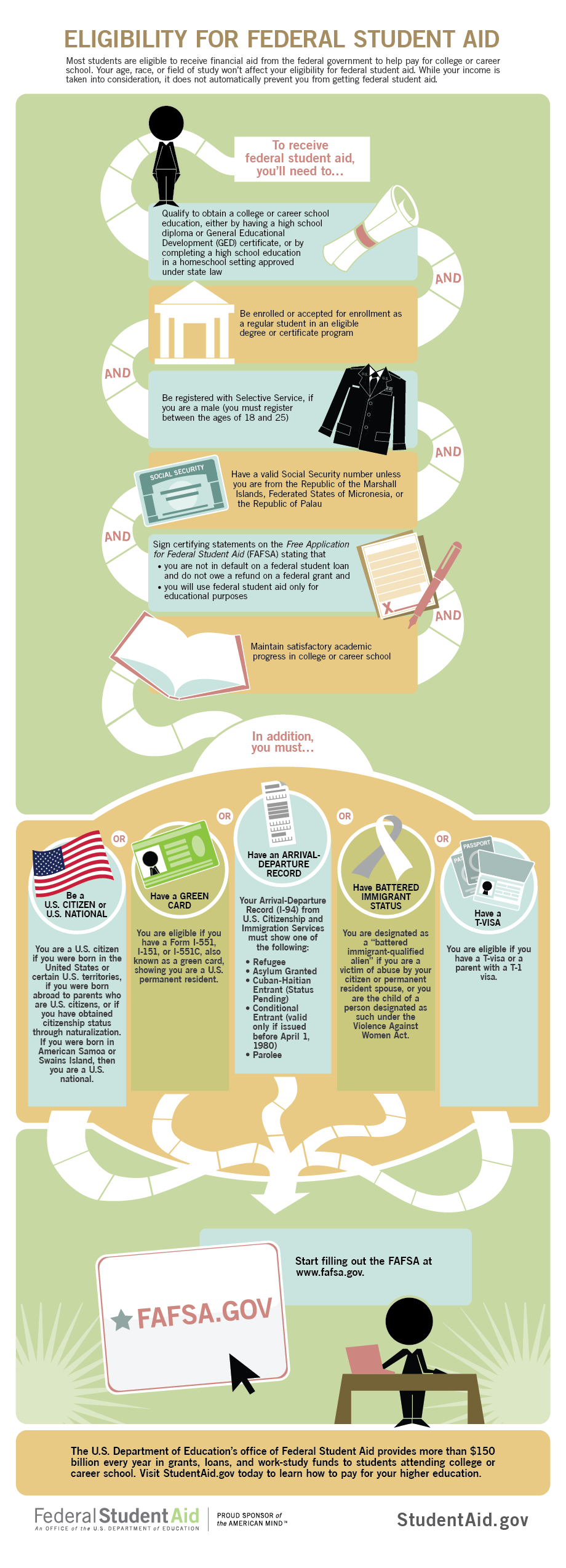

- All Title IV funds are awarded based on the information received from the FAFSA. You must complete the FAFSA to be eligible. The FAFSA can be found at fafsa.gov

- The 2024-2025 school year (July 1, 2024 – June 30, 2025) federal expiration date is June 30, 2025.

Deadlines are 10 days before the beginning of the new class.

| Session | Class Starting Date | Deadline |

| 2024 Summer B | 07/08/2024 | 06/28/2024 |

| 2024 Fall A | 08/19/2024 | 08/09/2024 |

| 2024 Fall B | 09/23/2024 | 09/13/2024 |

| 2024 Winter A | 10/28/2024 | 10/18/2024 |

| 2024 Winter B | 12/02/2024 | 11/22/2024 |

| 2025 Spring I A | 01/13/2025 | 01/03/2025 |

| 2025 Spring I B | 02/18/2025 | 02/07/2025 |

| 2025 Spring II A | 03/24/2025 | 03/14/2025 |

| 2025 Spring II B | 04/28/2025 | 04/18/2025 |

| 2025 Summer A | 06/02/2025 | 05/23/2025 |

- Once the FAFSA is received and processed, the school will receive a copy of an Institutional Student Information Record (ISIR), which summarizes the information you provided on your FAFSA. Awards are made on a first-come, first-served basis.

- Based on a student’s enrollment, estimated Cost of Attendance (COA) will be assigned for packaging purposes. The COA includes the following items:

- Tuition and Fees

- Books and Supplies

- Personal expenses

- Transportation cost

- Room and Board

- The SAI (2024–25 FAFSA form) is an eligibility index number that a college’s or career school’s financial aid office uses to determine how much federal student aid you would receive if you attended the school. This number results from the information that you provide in your FAFSA form.

Most of the tax information used to calculate the SAI is transferred directly from the IRS into the FAFSA form if you provide your consent and approval. (Some FAFSA applicants may need to manually provide tax information.) - Need-based aid is financial aid you can receive if you have financial need and meet other eligibility criteria. You can’t receive more need-based aid than the amount of your financial need.

- Your college or career school first determines whether you have financial need by using a simple formula:

Cost of Attendance (COA) – Student Aid Index (SAI) = Financial Need

- Your college or career school first determines whether you have financial need by using a simple formula:

The packaging methodology for undergraduate students:

- PELL Grants will be automatically awarded based on the student’s SAI and the PELL tables published by the U.S. Education Department.

- Columbia College Scholarship eligibility is determined based on the following eligibility requirements. (Refer to the Columbia College Scholarship Policy, 040-P01)

-

- Must be a U.S. citizen or eligible non-citizen

- Must file a Free Application for Federal Student Aid (FAFSA)

- Must file until a school’s FAFSA deadline

- Must be enrolled full-time or at least part-time in a certificate or associate degree program (excludes ESL program)

- Must demonstrate a significant financial need with the Student Aid Index (SAI)

- Amounts of disbursements will be determined by each program’s tuition on the disbursement date at the beginning of a term.

- All institutionally awarded scholarships and merit-based grants are included.

- Eligibility for Subsidized and/or Unsubsidized Direct Loans will be calculated and added to the package.

Financial Aid Rights & Responsibilities

- Academic school sessions at the Columbia College are designated in the following manner: 2024 Summer B, 2024 Fall, 2024 Winter, 2025 Spring I, 2025 Spring II, 2025 Summer A.

- Financial aid is based on your demonstrated financial need as calculated from the information on your FAFSA and from our estimate of your costs. Your award is based on your enrollment as part-time or full-time of each payment period (25 weeks).

- Once school begins each payment period, your grants and scholarships will be transferred directly to your student account.

- Your Pell and Columbia College Scholarship are estimated based on the pending federal funding confirmation, and/or verification of your reported financial information, which would circulate your Student Aid Index (SAI).

- Loan funds are applied only after you sign any required promissory note(s) and complete the required Entrance Counseling.

- First-time borrowers of Federal Direct Student Loans can complete an MPN and Entrance Counseling is required of all first-time borrowers at www.studentloans.gov before your loan eligibility can be confirmed at Columbia College. The loan counseling will help you understand the obligation you agree to meet as a condition for receiving a federal student loan.

- Student and parent borrowers of Title IV and HEA loans should be aware that the Columbia College is required to report information through the National Student Loan Data System (NSLDS) and that information is accessible by guaranty agencies, lenders, and schools determined to be authorized users of the data system.

- Loan eligible students, who wish to purchase their books and supplies with their credit balance, have the right to request to pay the application fee, textbook, and supply fee by the loan. This must be done by the end of the first week of classes in the payment period and before a refund is processed.

- Any funds received from any other sources must be reported to the Financial Aid Department. If an adjustment must be made to the aid offered, it will normally be a reduction of a loan.

- Exit Counseling is required at www.studentloans.gov. Before you graduate, leave school or drop below half-time attendance (even if you plan to transfer to another school). The exit counseling will help you understand your rights and responsibilities as a student loan borrower. It provides useful tips and information to help you prepare to repay your federal student loan as well.

- Students must maintain Satisfactory Academic Progress as defined by the Columbia College to receive financial aid.

- All aid offered is subject to verification of information provided on the application for aid. Your parents and/or you may be required to complete the IRS Data Retrieval process or submit copies of your federal income tax return transcripts

- A billing statement will be mailed before each session; payment is due by the beginning of a new session.

- Award offers are for one academic year. You must file a new FAFSA each year. The Columbia College of your aid may vary from year to year depending on your need.

Financial Aid Professional Judgment

Introduction & Purpose

The FAFSA Simplification Act (the Act) distinguishes between different categories of professional judgment by amending section 479A of the HEA.

Special Circumstances refer to the financial situations (loss of a job, etc.) that justify an aid administrator adjusting data elements in the COA or in the SAI calculation.

Unusual Circumstances refer to the conditions that justify an aid administrator making an adjustment to a student’s dependency status based on a unique situation (e.g., human trafficking, refugee or asylee status, parental abuse or abandonment, incarceration), more commonly referred to as a dependency override.

A student may have both a special circumstance and an unusual circumstance. Financial aid administrators (FAAs) may make adjustments that are appropriate to each student’s situation with appropriate documentation. See GEN-22-15 for additional guidance and discussion of the changes made by the FAFSA Simplification Act and implemented beginning with the 2024-25 Award Year.

Items that can be considered

The law gives some examples of special circumstances that may be considered (HEA Sec. 479A):

- Change in employment status, income, or assets;

- Change in housing status (e.g., homelessness);

- Tuition expenses at an elementary or secondary school;

- Additional family members enrolled in college;

- Medical, dental, or nursing home expenses not covered by insurance;

- Child or dependent care expenses;

- Severe disability of the student or other member of the student’s household; and

- Other changes or adjustments that impact the student’s costs or ability to pay for college.

The Head Financial Aid Administrator is expected and required to make reasonable decisions that support the intent of the provision. The school is held accountable for all professional judgment decisions made and for fully documenting each decision. All decisions are final and there is no appeal process.

Dependency Status and Overrides

Under HEA Sec. 480(d)(9), the FAFSA Simplification Act incorporated additional unusual circumstances to consider when a student is unable to contact a parent or where contact with parents poses a risk to such student.

Unusual circumstances do include (but are not limited to):

- Human trafficking, as described in the Trafficking Victims Protection Act of 2000 (22 U.S.C. 7101 et seq.);

- Legally granted refugee or asylum status;

- Parental abandonment or estrangement; or

- Student or parental incarceration.

In such cases an override might be warranted based upon the student’s individual circumstances. These conditions would also not disqualify a student from being a homeless unaccompanied youth or self-supporting and at risk of homelessness.

However, none of the conditions listed below, singly or in combination, qualify as unusual circumstances meriting a dependency override.

- Unusual circumstances do not include:

- Parents refuse to contribute to the student’s education.

- Parents will not provide information for the FAFSA or verification.

- Parents do not claim the student as a dependent for income tax purposes.

- Student demonstrates total self-sufficiency.

An aid administrator may override only from dependent to independent.

Additionally, the FAFSA Simplification Act introduced new requirements for processing and communicating with students who request an adjustment for unusual circumstances.

Students are considered dependent or independent based on information provided on the FAFSA.

Requesting a Dependency Override

To request a dependency override, ask to the college’s financial aid administrator for a dependency override.

- Summarize the circumstances that justify the dependency override.

- Provide copies of independent third-party documentation of the special circumstances, such as letters from social workers, clergy, teachers, guidance counselors, doctors or others who are familiar with the student’s situation.

- Copies of the student’s federal income tax return transcripts for the current and preceding year.

The letter of explanation requesting a Dependency Override along with all required documentation should be sent to the Office of Student Financial Assistance. The Office of Student Financial Assistance will respond in writing within 10 business days of receiving all documentation. Dependency overrides are for one year at a time. Financial aid administrators must verify that the unusual circumstances that justified the dependency override in a previous year continue to apply.

Estimated Cost of Attendance

Estimate Full-Time Cost of Attendance (2024-2025 Award Year)

- Review the standard estimates we use in calculating financial aid eligibility. They can be customized for variances in differences in tuition rates.

Certificate Programs

| Budget Item | Vocational English as Secondary Language | Massage Therapy | Dental Lab Technology | Culinary Arts | Cosmetology | |

| 50 Weeks | 30 Weeks | 50 Weeks | 50 Weeks | 50 Weeks | ||

| 1 | Tuition | $9,200 | $9,900 | $16,000 | $11,890 | $13,250 |

| 2 | Housing & Meals | $17,649 | $10,589 | $17,649 | $17,649 | $17,649 |

| 3 | Personal Expenses | $4,589 | $2,753 | $4,589 | $4,589 | $4,589 |

| 4 | Transportation | $2,297 | $1,378 | $2,297 | $2,297 | $2,297 |

| 5 | Book & Supplies | $659 | $330 | $1,500 | $400 | $1,400 |

| 6 | Licensing, certification, or professional credential fees* | N/A | $450 | N/A | N/A | $110 |

| 6 | Fees** | $100 | $200 | $200 | $200 | $200 |

| Total COA | $34,494 | $25,556 | $42,235 | $37,025 | $39,495 |

*The fee of Massage Therapy includes the cost for initial Licensure (Virginia). Please note that application fees may vary depending on the state.

** The fee includes the application fee.

Associate Programs

| Budget Item | Dental Lab Technology | Culinary Arts | Business Administration |

Information Technology | Technical and Business English | Early Childhood Education | |

| 50 Weeks | 50 Weeks | 50 Weeks | 50 Weeks | 50 Weeks | 50 Weeks | ||

| 1 | Tuition | $18,580 | $16,700 | $14,100 | $14,100 | $14,100 | $14,100 |

| 2 | Housing and Meals | $17,649 | $17,649 | $17,649 | $17,649 | $17,649 | $17,649 |

| 3 | Personal Expenses | $4,589 | $4,589 | $4,589 | $4,589 | $4,589 | $4,589 |

| 4 | Transportation | $2,297 | $2,297 | $2,297 | $2,297 | $2,297 | $2,297 |

| 5 | Book & Supplies | $1,400 | $400 | $1,751 | $1,751 | $1,751 | $1,751 |

| 6 | Fees | $200 | $200 | $200 | $200 | $200 | $200 |

| Total COA | $44,815 | $41,835 | $40,586 | $40,586 | $40,586 | $40,586 |

Columbia College Scholarship

Columbia College Scholarship provides need-based grants to assist low-income students in covering the costs of post-secondary education.

Eligibility Requirements

- Must be a U.S. citizen or eligible non-citizen

- Must file a Free Application for Federal Student Aid (FAFSA)

- Must file prior to the school’s FAFSA deadline

- Must be enrolled full-time or at least part-time in a certificate or associate degree program (excluding the ESL program)

- Must demonstrate a significant financial need with the Student Aid Index (SAI)

- Amounts of disbursements will be determined by each program’s tuition on the disbursement date at the start of the term.

Award Amount

The annual maximum amount of Columbia College Scholarship is $4,000, depending on the student’s financial need, when s/he applies, and the availability of funds and policies of the financial aid office at Columbia College. Columbia College Scholarship does not need to be repaid.

Selection Procedures

Columbia College must ensure that Columbia College Scholarship recipients are selected based on the following procedures.

- First, Columbia College Scholarship recipients are selected on the basis of their SAI, which must be zero or negative.

- Second, the remaining Columbia College Scholarship funds will be distributed to the eligible Columbia College Scholarship recipients at the next session.

- If it is the last session of an award year, the remaining Columbia College Scholarship funds will be distributed to the eligible FESOG recipients with the lowest SAI who are not receiving Pell Grants the last session of a year.

Application Process

Applicants should understand that Columbia College Scholarship application process is more

competitive than the Federal Pell Grant application process and priority funding will always be

awarded to those with the greatest financial need.

To receive a Columbia College Scholarship award, students must complete the Free Application for

Federal Student Aid (FAFSA). Students who will receive a Federal Pell Grant and have demonstrated a need will receive Columbia College Scholarship (based upon availability of funding). The FAFSA can be completed on the Web at studentaid.gov. If the student is approved for Columbia College Scholarship award, the student’s tuition account will be credited by the financial aid office.

Verification

The U.S. Department of Education mandates school use the verification process to confirm the accuracy and completeness of information provided on the FAFSA. The verification process is meant to ensure that Federal student financial aid is disbursed equitably and according to Federal law and program regulation.

The Federal Processor determines who is selected for verification. If selected by the Federal Processor, the student is notified on the Student Aid Index (SAI). The Financial Aid Department of Columbia College also has the authority to select files for verification if a conflict of information is determined.

Verification Process

- If a student’s application has been selected for verification, the student will be notified on the SAR.

- Typically, the students can expect to receive notification that they have been selected for verification within 3~4 business days after they apply for FAFSA.

- The Financial Aid Office receives the student’s FAFSA result from the federal processors & notifies by phone and/or e-mail & sends a Verification Letter & Verification worksheet to those students who have been selected for verification.

- The Verification Letter will direct the student to submit several required documents with the verification worksheet together to the Financial Aid Office.

- Students must complete the required documents in their entirety, sign, and mail them to the Financial Aid Office at least 30 days before the start of the next payment period that you register for.

Elements to be verified

The Financial Aid Office may be required to verify the following data elements on your FAFSA:

- Adjusted Gross Income

- Income Earned from Work

- U.S. Income Tax Paid

- Untaxed portions of IRA distributions

- Untaxed portions of pensions

- IRA deductions and payments

- Tax exempt interest income

- Education Credits

- Foreign income exempt from federal taxation

- Family Size

- Identity

- Statement of educational purpose (SEP)

Documents Needed to Complete Verification

There are three verification groups for the 2024-2025 award year. To verify these elements, the Financial Aid Office may request that you provide the following documents based on your group selected.

| Groups | Independent (or Dependent) |

| V1-Standard |

|

| V4-Custom |

|

| V5-Aggregate |

|

Note: If the student has not filed the 2022 Tax Return, he/she will need to provide documentation from the IRS that indicates a 2022 IRS income tax return was not filed with the IRS.

Income Information for Tax Filers

| FAFSA Information | Acceptable Documentation |

| (a) Adjusted Gross Income (AGI) (b) Income Earned from Work

(c) U.S. Income Tax Paid (d) Untaxed Portions of IRA Distributions (e) Untaxed Portions of Pensions (f) IRA Deductions and Payments (g) Tax Exempt Interest Income (h) Education Credits (i) Foreign Income Exempt from Federal Taxation |

Items (a) through (h), if transferred directly from the IRS and unchanged, do not need to be verified. When information is not transferred from the IRS, and for item (i), the following documentation is sufficient for verification:

|

Income Information for Non-Tax Filers

| FAFSA Information | Acceptable Documentation |

| Income Earned from Work | For an individual who has not filed and, under IRS or other relevant tax authority rules (e.g., the Republic of the Marshall Islands, the Republic of Palau, the Federated States of Micronesia, a U.S. territory or commonwealth or a foreign government), is not required to file a 2022 income tax return—

|

For non-tax filers, you provide a W-2 form for each source of 2022 employment income and a signed statement certifying that you have not filed and are not required to file a 2022 tax return. You must also fill out a signed statement giving the sources and amounts of the person’s income earned from work not found on W-2s. Students may sign on a nonfiling spouse’s behalf.

For residents of the Freely Associated States (the Republic of the Marshall Islands, the Republic of Palau, or the Federated States of Micronesia), a copy of the wage and tax statement from each employer (substitute for W-2s) and a signed statement identifying any other employment income for the year not identified on the wage and tax statement is acceptable. Persons from a U.S. territory, commonwealth, or a foreign country who are not required to file a tax return can provide a signed statement, as well as any supporting documentation they might have (e.g., a form comparable to a U.S. W-2), certifying their income.

If a W-2 is not Available

If an individual who is required to submit an IRS Form W-2 did not save a copy, they should request a replacement W-2 from the employer who issued the original. A W-2 transcript from the IRS is also acceptable though it generally is not available until the year after the W-2 information is filed with the IRS (e.g., 2024 for 2022 information filed in 2023). If they are unable to obtain one in a timely manner, you may permit them to provide a signed statement that includes the amount of income earned from work, the source of that income, and the reason why the W-2 is not available in a timely manner.

How to apply for Tax Return Transcript from the IRS

IRS Tax Return Transcript Request Process (Not Tax Account Transcript)

Tax filers can request a transcript, free of charge, of their 2022 Federal Income Tax Return Transcript from the IRS in one of the following ways.

OPTION 1: Online Immediate Assess to Your Electronic Tax Transcript (Number)

- Go to www.irs.gov, click “Get Your Tax Record.”

- Click “Get Transcript Online.”

- Make sure to request the “Return Transcript” and NOT the “Account Transcript.” To use the Get Transcript Online tool, the user must have

- Access to a valid email address

- a text-enabled mobile phone (pay-as-you-go plans cannot be used) in the user’s name, and

- specific financial account numbers (such as a credit card number or an account number for a home mortgage or auto loan).

- The transcript displays online upon successful completion of the IRS’s two-step authentication.

OPTION 2: Online Request for Mailed Transcript

- Go to www.irs.gov, click “Get Your Tax Record.”

- Click “Get Transcript by Mail.”

- Make sure to request the “Return Transcript” and NOT the “Account Transcript.”

- The transcript is generally received within 10 business days from the IRS’s receipt of the online request.

OPTION 3: Telephone Request for Mailed Transcript

- Available on the IRS by calling 1-800-908-9946. Transcript is generally received within 10 business days from the IRS’s receipt of the telephone request.

If one of above three ways was unsuccessful, please do the following step.

OPTION 4: Paper Request for mailed Transcript–IRS Form 4506T-EZ or 4506-T(Number)

IRS Form 4506T-EZ or IRS Form 4506-T. The transcript is generally received within 10 business days from the IRS’s receipt of the paper request form

- IRS Form 4506T-EZ should be used. (Download 4506T-EZ)

- Mail or fax the completed IRS Form 4506T-EZ to the appropriate address (or FAX number) provided on page 2 of Form 4506T-EZ.

- Tax filers can expect to receive their transcript within 5 to 10 days from the time the IRS receives and processes their signed request.

- Processing form 4506T-EZ means verifying the information provided on the form. If any information does not match the IRS records, the IRS will notify the tax filer that it is not able to provide the transcript.

- If the IRS cannot provide tax transcript, submit the following four documents.

- Tax non-filers have to use IRS Form 4506-T (Download at 4506-T ) with check #7 Verification of Non-filing.

- If the IRS cannot provide the tax transcript, the following four documents must be submitted by the student.

Documents must be submitted to Columbia College

- A signed copy of tax refund of prior year

- The printed IRS Web pages with the message (1&2)

- The copy of the completed and signed Form 4506T-EZ

- The copy of the IRS response to Form 4506T-EZ with signature and date by student

How to submit corrections and updates

Corrections and updates can be submitted by the student on the SAR or the Web.

- Using the Student Aid Report (SAR): students may make corrections or updates on it, then sign and return it to the FAFSA processor at the address given at the end of the SAR.

- Using FAFSA on the Web: students may correct any of his/her own data by using FAFSA on the Web at fafsa.gov.

- If dependent students need to change parental data, a parent must either sign electronically or print out and sign a signature page and then return it to the FAFSA processor.

- Updated SAR are provided by the federal processor

- If changes are made to the FAFSA, the student is responsible for notifying the school of any changes made to an existing financial aid award package as a result of verification.

Last day to submit verification documents

| New & Renewal students: | Before starting of new session |

| Students falling deadline | At least 30 days before the beginning of the next payment period |

Verification Deadline and Consequences of Failing Deadline

If selected, there are negative consequences resulting from failure to complete verification within specified deadlines. Federal verification regulations require the following:

- Federal financial aid cannot be disbursed until verification is complete

Your role in the above case

- You must deposit a check for half session tuition and fees (5 weeks) immediately, which will be on hold until your verification is completed.

- To complete verification, you must submit the required documents at least 30 days before the beginning of the next payment period.

- If you complete verification within the time limit, the check will be returned.

- If you couldn’t complete verification within the time limit, the check will be deposited for deferment of tuition and fees.

Contact Information

Verification documentation may be submitted to the Financial Aid Office by mail, fax, or email. Verification documents and questions can be sent via email to financialaid@ccdc.edu. If you have questions regarding your verification, please contact Columbia College at (703)-206-0508 or financialaid@ccdc.edu.

Federal Aid Refund

Withdrawal and Return of Title IV Funds (R2T4) Policy

Purpose

This written policy provides guidance for returning federal funds of students withdrawing from Columbia College. It is required that a Return of Title IV Funds (R2T4) calculation is performed for students who receive Title IV Funds and withdraw from all courses to determine the percentage of aid earned based on the amount of time the student enrolled.

How a Withdrawal Affects Financial Aid

Title IV Federal student aid is awarded under the assumption that a student will attend class for the entire payment period (period for which the aid was awarded). When a student withdraws from all courses, he/she may no longer be eligible for the full amount of Title IV funds originally awarded. The return of funds to the federal government is based on the premise that a student earns financial aid in proportion to the length of time of student enrollment. A pro-rated schedule determines the amount of federal student aid funds he/she earned at the time of full withdrawal. Once the 60% point in the payment period is reached, a student is considered to have earned all financial aid originally awarded and no return is required.

R2T4 calculation is not required when the student failed to begin attendance or when a student has a change of credits/hours and did not fully withdraw from all courses that he/she enrolled.

Determination of Withdrawal Date

The withdrawal date used in the R2T4 calculation is the actual last date of attendance (including academic engagement) written on the withdrawal form.

Withdrawing Prior to the 60% Point of a Payment Period

Unless and until a student completes 60% of the payment period in which financial aid was awarded, the student will be required to return all, or part of the financial aid originally awarded for the payment period.

When a Student Fails to Begin Attendance

If financial aid is processed for a student who does not/fails to begin attendance in any class for which he/she enrolled in a session, all aid will be canceled.

The entire amount except the application fee ($100) paid by the student will be fully refunded if the student chooses not to enroll before the first day of class.

Credit Balances as a Result of a R2T4 Calculation

If an R2T4 calculation is required and the student has a pending credit balance, the credit balance will not be released to the student or parent until the R2T4 calculation is completed. Once the R2T4 calculation is completed and it is determined that the student is entitled to a credit balance, the funds will be disbursed to the student or parent as soon as possible, but no later than 14 days after the date of the R2T4 calculation is completed.

If an R2T4 calculation is required and the student does not have a pending credit balance, the school will perform the R2T4 calculation. If it is determined that a student is entitled to a credit balance due to the R2T4 calculation, the funds will be disbursed to the student or parent as soon as possible, but no later than 14 days after the date of the R2T4 calculation is performed.

According to the Return of Title IV (R2T4) Funds policy, the student is allowed to retain only the amount of Title IV financial aid that was earned. If a student withdraws or stops participating in classes, a portion of the aid received is deemed unearned and must be returned to the Title IV programs. If the R2T4 calculation results in unearned aid that must be returned, both the school and the student are responsible for returning funds.

How Earned Financial Aid is Calculated

Financial aid recipients “earn” the aid they originally received by attending classes. The earned amount is calculated based on a pro-rated system. Students who withdraw or do not complete all classes in which they were enrolled may be required to return some of the aid originally awarded.

It is required for the Financial Aid office of Columbia College to determine the percentage of Title IV aid “earned” by the student and return the “unearned” portion to the federal aid programs. This calculation is completed within 30 days of the date the school determines that a student has withdrawn. The school must return the funds within 45 days of the date of determination of withdrawal. The Financial Aid office completes the R2T4 calculation.

The return of Title IV funds policy follows these steps:

Step 1: Student’s Title IV information

The Financial Aid Office will determine:

- The total amount of Title IV aid disbursed (not aid that could have been disbursed) for the payment period in which the student withdrew. A student’s Title IV aid is counted as aid disbursed in the calculation if it has been applied to the student’s account on or before the date the student withdrew.

- The total amount of Title IV aid disbursed plus the Title IV aid that could have been disbursed for the payment period in which the student withdrew.

Step 2: Percentage of Title IV Aid Earned:

The Financial Aid Office will calculate the percentage of Title IV aid earned as follows:

- The number of calendar days completed by the student divided by the total number of calendar days in the payment period in which the student withdrew. The total number of calendar days in a payment period shall exclude any scheduled breaks of more than five days.

Days Attended ÷ Days in Payment Period = Percentage Completed

If the calculated percentage exceeds 60%, then the student has “earned” all Title IV Aid for the payment period.

Step 3: Amount of Title IV Aid Earned by the Student

The Financial Aid Office will calculate the amount of Title IV Aid earned as follows:

- The percentage of title IV aid earned (Step 2) multiplied by the total amount of Title IV aid disbursed or that could have been disbursed for the term in which the student withdrew (Step 1-B).

Total Aid Disbursed x Percentage Completed = Earned Aid

Step 4: Amount of Title IV Aid to be Disbursed or Returned:

- If the aid already disbursed equals the earned aid, no further action is required.

- If the aid already disbursed is greater than the earned aid, the difference must be returned to the appropriate Title IV aid program.

Total Disbursed Aid – Earned Aid = Unearned Aid to be Returned

Order of Funds to be Returned

According to federal regulations, the calculated amount of the R2T4 Funds (unearned aid) is to be allocated in the following order:

- Unsubsidized Federal Stafford Loans

- Subsidized Federal Stafford Loans

- Federal Parent (PLUS) Loans

- Federal Pell Grants for which a Return of funds is required

- Columbia College Scholarship for which a Return of funds is required

Loans must be repaid by the loan borrower (student/parent) as outlined in the terms of the borrower’s promissory note.

The student’s grace period for loan repayments for Federal Unsubsidized and Subsidized Stafford Loans will begin on the day of the withdrawal from the University. The student should contact the lender if he/she has questions regarding their grace period or repayment status.

Institutional and student responsibility in regard to the Federal Return of Title IV Funds policy

The Financial Aid Office’s responsibilities include:

- Informing students with the information in this policy

- Identifying students who are affected by this policy and completing the return of Title IV funds

- Informing students of the result of the R2T4 calculation and any balance owed to the school as a result of a required return of funds

- Returning any unearned Title IV aid that is due to the correct Title IV programs and, if applicable notifying the borrower’s holder of federal loan funds of the student’s withdrawal date

- Notifying student and /or Plus borrower of eligibility for a Post-Withdraw Disbursement, if applicable;

The student’s responsibilities include:

- Becoming familiar with the Return of Title IV Funds policy and how withdrawing from all his/her courses affects eligibility for Title IV aid;

- Resolving any outstanding balance owed to Columbia College resulting from a required return of unearned Title IV aid.

Information Regarding Loan Repayment

The R2T4 calculation may result in the student and parent being responsible for directly returning additional loan amounts to the U.S. Department of Education.

The loan grace period begins on the withdrawal date from the school, or when a student ceases to be enrolled on at least a half-time basis. If the student does not re-enroll as a half-time student within 6 months of withdrawal or less than half-time enrollment, the loans enter repayment. The student should contact the loan servicer or the U.S. Department of Education to make repayment arrangements. The promissory note signed by the borrower outlines repayment obligations. The student should contact the servicer or the U.S. Department of Education with any questions.

Consequences of Non-Repayment

Students who owe the US Department of Education for an overpayment of TIV funds are not eligible for any additional federal financial aid until the overpayment is paid in full or payment arrangements are made with the U.S. Department of Education.

Students who owe funds to Columbia College because of an R2T4 calculation will be placed on a financial hold. They will not be allowed to register for subsequent sessions or receive academic transcripts until the balance is paid.

How a Withdrawal Affects Future Financial Aid Eligibility

Students who owe the U.S. Department of Education for an overpayment of Title IV funds may not be eligible for any additional federal financial aid until the overpayment is paid in full or payment arrangements are made with the U.S. Department of Education.

The Satisfactory Academic Progress (SAP) Policy shows how a withdrawal can have an impact on financial aid eligibility.

This Policy is revisited and evaluated on a regular basis and is subject to revision without prior notice as it can be revised based on changes to federal regulations or Columbia College policies. If/when changes are made, the student is held responsible for the most updated policy.

HEOA Consumer Information

In accordance with the 2008 Higher Education Opportunity Act (HEOA), you can find complete

consumer information on our website at financialaid.ccdc.edu. For more information on HEOA,

visit U.S. Department of Education.