Direct Subsidized and Unsubsidized Loans

Federal Direct Subsidized and Unsubsidized Loans are federally supported, low-interest student loans with flexible repayment options. Subsidized loans are offered to undergraduate students who are eligible on the basis of calculated need, while unsubsidized loans are available to both undergraduate and graduate students even for those who do not qualify for need-based financial aid.

150% Rule for Subsidized Loans

As of July 1, 2013, a first-time Federal Direct Subsidized Loan borrower is no longer eligible for the Subsidized Direct Loan Program and the interest subsidy if he or she exceeds 150% of the published length of the student’s undergraduate degree program. This regulation defines a “first-time borrower” as someone who either has never borrowed a Subsidized Loan or is a student that has paid off all outstanding balances on either a Direct or Federal Family Educational Loan Program.The U. S. Department of Education wants to encourage students to obtain undergraduate degrees within a reasonable time frame and no longer wants to provide interest rate subsidies for students taking an exceptional amount of time to obtain an undergraduate degree. Students who change majors, drop classes or retake classes excessively are most likely to be affected by this federal regulation. Presently, the interpretation of the 150% rule is actual credit hours completed versus credit hours attempted. Please view the following link for additional information: Direct Subsidized Loan Time Limitation

How to Apply for Direct Loan?

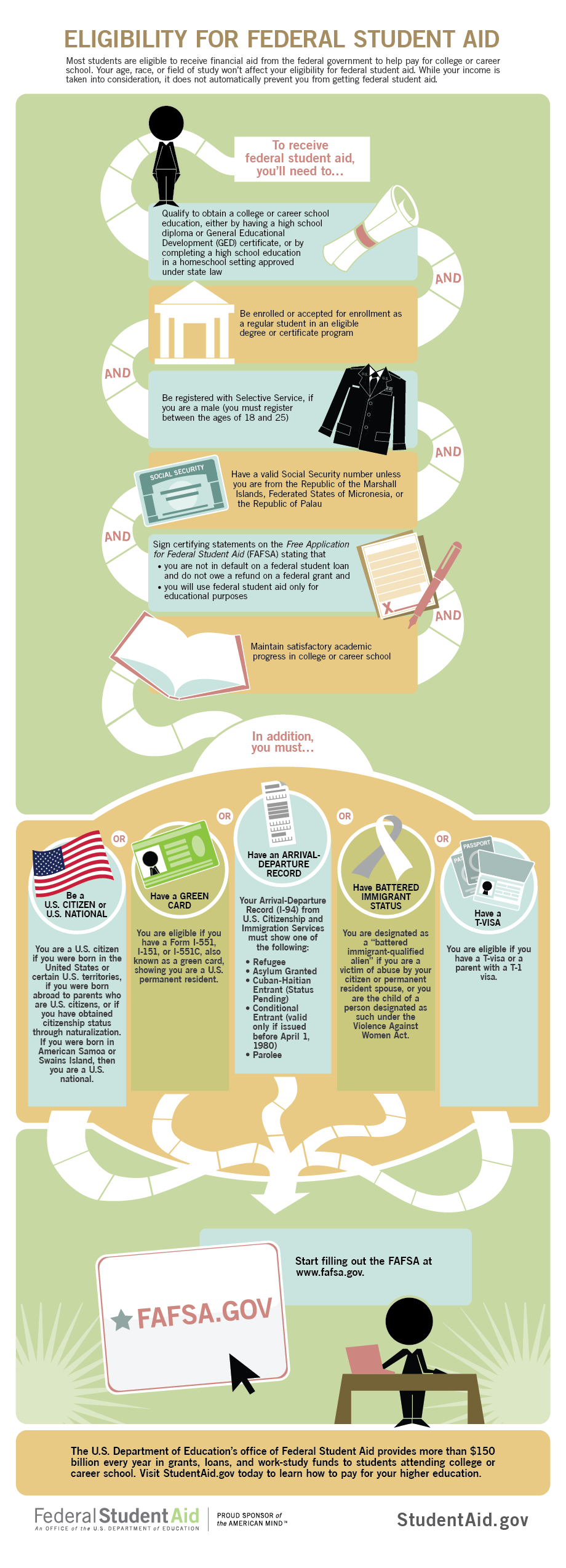

- Submit the Free Application for Federal Student Aid (FAFSA) for determination of Federal Direct Subsidized and/or Unsubsidized Loan eligibility. Include the Columbia College FAFSA school code, 041273

- Complete Entrance Counseling and the Master Promissory Note (MPN)

- Submit Direct Loan Request Form to the Financial Aid Department

- The Federal Aid Officer will confirm the eligibility and notify you immediately if you are approved.

Types of Loan Details

| Federal Direct subsidized Loan |

|

| Federal Direct unsubsidized Loan |

|

PLUS Loan

The Federal Direct Parent PLUS loan is a form of financial aid that is designed for the parents of dependent students to help them pay for college. This is a credit based loan, and the interest rate is fixed at 8.05 percent. Interest is charged during all periods.

How to Apply for Parent Plus Loan?

- Submit the Free Application for Federal Student Aid (FAFSA). Include the Columbia College FAFSA school code, 041273

- Apply the parent’s PLUS Loan by completing Entrance Counseling and the Master Promissory Note (MPN)

- Submit PLUS Loan Request Form to the Financial Aid Department

- The Federal Direct loan program will complete a credit check, and forward your application to our office to verify enrollment and eligibility.

- The Federal Aid Officer will confirm the eligibility and notify you immediately if you are approved.

Parent eligibility requirements for a Direct PLUS Loan

Applying for a PLUS Loan and the Master Promissory Note (MPN)

If the parent is borrowing Direct PLUS Loans for more than one student, he/she will need to complete a separate MPN for each one. To complete an MPN online, you will be required to use your FAFSA ID and password.

Credit Check & Endorser Alternative

To be eligible for a PLUS Loan, the parent must not have an adverse credit history, which the Department will check for when he/she applies for the loan. If the parent is found to have an adverse credit history, he/she may still borrow a PLUS Loan if the parent gets an endorser who does not have such a history. An endorser is someone who agrees to repay the loan if the parents do not. The endorser may not be the student on whose behalf a parent obtains a PLUS Loan. Types of AidDetailsPLUS Loans for parents of dependent undergraduate students

- Credit-qualified education loans, approval based on the parent’s creditworthiness

- Interest rate of 8.05% with no grace period (minus 4.228% loan origination fee)

- The borrower is responsible for all interest even though the borrower is in school.

Entrance & Exit Counseling

ENTRANCE COUNSELING is required of all first-time borrowers before your loan eligibility can be confirmed at Columbia College. The loan counseling will help you understand the obligation you agree to meet as a condition for receiving a federal student loan. If you are a student taking out a Direct Subsidized Loan or a Direct Unsubsidized Loan, you must sign an MPN.

To begin Direct Loan Entrance Counseling, go to Entrance Counseling.

The Master Promissory Note (MPN) is a legal document in which you promise to repay your loan(s) and any accrued interest and fees to the U.S. Department of Education (ED). It also explains the terms and conditions of your loan(s); for instance, it will include information oh how interest is calculated and what deferment and cancellation provisions are available to you. At the end, you need to provide the name address, e-mail address, and telephone number for your closest living relative, two references who live in the U.S. You can complete the MPN at Master Promissory Note (MPN). In most cases, once you’ve submitted the MPN and it’s been accepted, you won’t have to fill out a new Direct Loans on a single MPN for up to 10 years. You’ll receive a notification statement that gives you specific information about any loan that the school plans to disburse under your MPN, including the gross loan amount and the expected loan disbursement dates.

EXIT COUNSELING is required before you graduate, leave school or drop below half-time attendance (even if you plan to transfer to another school). The exit counseling will help you understand your rights and responsibilities as a student loan borrower. It provides useful tips and information to help you prepare to repay your federal student loan as well.

At the end, you need to provide the name, address, e-mail address, and telephone number for your closest living relative, additional one reference who live in the U.S., and current or expected employer (if known).

To begin Direct Loan Exit Counseling, go to Exit Counseling.

Average student loan debt by year

The average debt at graduation in 2023 is $6,680.

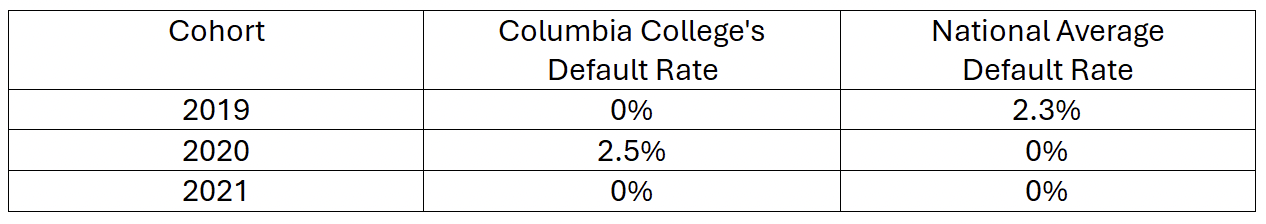

Cohort Default Rate

The Cohort Default Rate (CDR) is the percentage of a college’s student borrowers who enter repayment on Federal Direct Loans during a specific fiscal year and default on those loans within the cohort default period. The rate is calculated annually by the U.S. Department of Education and is based on borrowers who entered repayment on certain loans during a particular federal fiscal year, from October 1st to September 30th, and defaulted or met other specified conditions prior to the end of the second following fiscal year.

The Cohort Default Rate (CDR) for recent years is as follows:

NSLDS

The National Student Loan Data System (NSLDS) is the U.S. Department of Education’s (ED’s) central database for student aid. NSLDS receives data from schools, guaranty agencies, the Direct Loan program, and other Department of ED programs. NSLDS Student Access provides a centralized, integrated view of Title IV loans and grants, so that recipients of Title IV Aid can access and inquire about their Title IV loans and/or grant data.

NSLDS student access at nsldsfap.ed.gov.

Please note that loan information for student/parent who enter into an agreement regarding Title IV, HEA will be submitted to the National Student Loan Data System and will be accessible by authorized agencies, lenders, and institutions.